Hodling Experiment: Committing To Blockchain Technology Through Cryptocurrency

This post was originally published on my Medium blog and can be found here. I hope you enjoy and find this helpful!

To help you better understand this, here’s the direct excerpt from their White Paper:

To help you better understand this, here’s the direct excerpt from their White Paper:

It’s been quite a roller-coaster the past year, hasn’t it? At the beginning of 2017, the price of Bitcoin was $962.48, now $10,009.20; Ethereum was $8.19, now $756.70; Litecoin was $4.36, now $186.73; and NEO was $0.14, now $100.83. It’s not wonder we’ve seen such a mass exodus from the world of FinTech to the crypto markets, thankfully. Not only that, but 2017 was the year that Bitcoin truly went viral. Meaning, most human beings have now heard of Bitcoin as the cryptocurrency.

Over this time, we have seen many corporations begin to partner with projects that conducted an Initial Coin Offering (ICO), real companies. So much so that the ecommerce behemoth, Overstock, is running an ICO — people are waking up. So are the world governments. Though anybody in the space that has spent more than a couple hours researching into blockchain technology and cryptocurrencies knew governments would eventually realize this is either beginning to impact their economy or is an opportunity to impact the economy on a large scale.

In fact, Coinbase just came out the other day announcing they opened up an index for accredited investors to begin building exposure to this volatile asset class. ‘The Dow of Crypto.’ While the top market cap cryptocurrencies waiver their time in the spotlight, let’s not forget about the 1,000’s of blockchain, cryptocurrency-based projects that launched over the past year. 2018 will be the year some of these projects begin to deliver their products and services. In this piece, we’ll take a look at a fun little experiment I’m running with a coin called MinexCoin — the first blockchain project to ever successfully nail the decentralized savings account/certificate of depositwith interest paid.

MinexBank: The One-of-a-kind Blockchain

In order to catch you up on what the core concept of MinexCoin’s MinexBank is, I’ve included the picture above. If you’d like to dig further, here is an article I wrote explaining MinexBank in greater detail. With the rush of governmental regulations being worked on behind the doors of each country’s respective leadership and financial institutions getting their grimy hands on Bitcoin, cryptocurrency can use an upbeat article.

MinexCoin launched their Token Sale in May of 2017 with the proposition of being a more stable cryptocurrency that could be better relied on for payment processing. Their goal is to revolutionize the way payments are done.

Shortly after their token sale ended, they listed on Livecoin exchange. Now, the core component of the project is the algorithm to MinexBank that helps keep MNX stable through a volatile and expanding cryptocurrency market.

I was unable to participate in their token sale, but did take notice how involved their leadership team was and the fact that ERC-20 tokens were being launched left and right — not as entire blockchain networks with their own coin.

While their team was busy at conferences and building their technology, the updates were a bit infrequent until we broke through into the new year. MinexCoin came out with some great branding movesand released their MinexBank project on their testnet — this was my true confirmation that the project wasn’t another scam project and was taking their mission very seriously.

Soon after, they announced the official launch of the MinexBank where users can participate in ‘parking’ their MNX coins on their desktop, receiving MNX in return for helping secure the stable price of the MNX coin.

Where Do MNX Parking Rewards Come From?

A couple days after publishing this article and sharing it with the MinexCoin community chat channel, one of our community members (Kryptotitan) mentioned me in a response with some helpful feedback. So helpful, I wanted to screenshot and insert it here.

To explain further, MinexBank’s price stability algorithm aims to keep the price within 5% of the previous day’s closing price. Once this 5% mark is hit on a daily basis, the MinexBank has two options:

- 1. changes interest rates for MNX parking payouts in MinexBank or

- 2. MinexBank will automatically intervene to keep the price within the preset range.

- From what I gather here, MinexBank’s algorithm will either decide to increase/decrease the MNX parking interest rate or automaticallysell/buy coins on the market to maintain the 5% price growth stability.

Initially, MinexBank has an MNX reserve with an option of continuously filling it up so that the system could work on a long-term basis and suppress possible speculative attacks.

The initial reserve is formed by premining 1,500,000 coins. Once there are more MinexCoins on the market due to additional issuance (miner work rewards), the reserve will have to be replenished and eventually expanded (Network fees). The growth will be ensured by the progressive percentage of payments to MinexBank for each block solved by miners.

What is the Fun Experiment I mentioned?

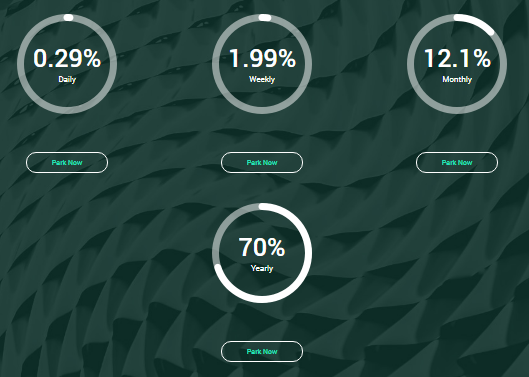

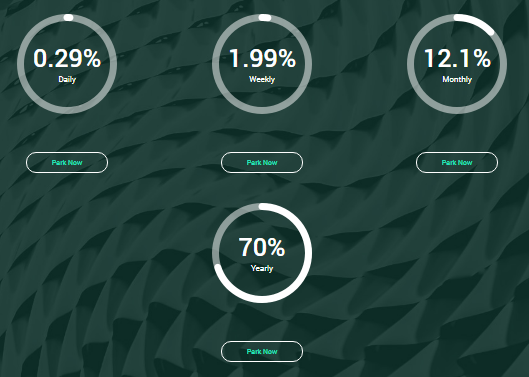

Above are the current rates MinexBank offers for parting one’s MNX — notice the intervals: 1-day, 1-week, 1-month and 1-year. The current fees for sending MNX are currently 0.00001 MNX and at the current price of $30, that’s $0.0003 per transaction. Not too bad at all and this has been their fee while Bitcoin was reaching $50 per transaction for a brief period of time.

Now, the experiment I’m going to attempt is parking a small fraction of MNX for 1-year every. Single. Day. For the rest of the year, about 9-months.

The amount will be between 0.01–0.25 MNX per day so that this is worthwhile in 2019. At a price of $30, that’s $0.3–7.5 per day everyday.

Atomic swap-driven decentralized exchange?

Why am I doing this “experiment”?

- as a testiment of my belief that blockchain, cryptocurrency-centrictechnology will continue to prevail through late 2019;

- to lead by example by adopting the technology as a user and supporter — our frequent parking will help them further develop the MinexBank stability algorithm; and

- as a fun and risky way to potentially earn a return in the future.

Keep in mind that I started this today. So for the next nearly 9-months, I will park MNX everyday. Meaning I will not be able to send the parked MNX outside of my wallet or my MNX coins will no longer earn the parking rate in 2019. The date the parked MNX can be accessed by me will be March-December of 2019. It’s a very long time, but 1-year is currently 70% and nowhere in the traditional world will I find that rate. My thoughts are,

“People became wealthy by becoming early adopters. Why not play the risk-reward correlation game and stake some coins at the 70% rate? If MNX is another Bitcoin — accessing those coins will be fun in 2019. If MNX is a piece of technology that is beat out at anytime within the next 21-months —my coins may be worthless.”

To get a better idea what what I will be doing, I’ve created an ‘example parking schedule’:

If you’re interested in following the daily updates, follow the series:

“People became wealthy by becoming early adopters. Why not play the risk-reward correlation game and stake some coins at the 70% rate? If MNX is another Bitcoin — accessing those coins will be fun in 2019. If MNX is a piece of technology that is beat out at anytime within the next 21-months —my coins may be worthless.”

To get a better idea what what I will be doing, I’ve created an ‘example parking schedule’:

By committing to this experiment, I am missing out on a lot of potential growth I could have made during the 21-month time span in other areas of my portfolio. Hence, the risk-reward correlation. This project might not even exist in 21-months, I really don’t know. I do know, however, that the project has existed for nearly a year now and has done nothing but deliver quality updates to the community on time. Not only that, with the introduction of their atomic swap capabilities, MinexCoin may be one of the first small-cap chains to introduce the atomic swap feature in a decentralized exchange (DEX) style. Only time will tell.

If you’re interested in following the daily updates, follow the series:

Disclaimer: Not a word in here should be taken as financial advice because it is not and I am not in a position to give financial advice. I do not value money as much as I value innovative solutions that have the ability to drastically improve the lives of humans across the world. At a bare minimum, MinexCoin has become the first to create a truly decentralized savings account and for that, I applaud the leadership team and their efforts.

Official links to MinexCoin education resources below:

Below are some resources for beginning cryptocurrency enthusiasts or others interested in something new:

The links below include affiliate/referral links which help support me as a writer. I do not get paid to write and this is my only means to generating income for writing. Thank you in advance and hope these resources are helpful to you. I only include resources in this list that I have used in the past.

- History of Cryptocurrency Exchanges — insightful look into the token-based exchange model and how exchanges have evolved.

- Cryptoversity by Chris Coney — The Online School That Pays You To Learn About Bitcoin, Crypto-currencies and Blockchains

- HitBTC Exchange — major exchange, access ICOs and multi-currencies.

- CoinTracking — Your personal Profit / Loss Portfolio Monitor and Tax Tracker for all Digital Coins

- Changelly — as easy as purchasing cryptocurrency gets — watch the exchange rate.

- CoinMate.io — Bitcoin arbitrage made easy.

- CEX.io — Buy Bitcoin w/ credit card, ACH bank transfer, SEPA transfer, cash, or AstroPay. Credit purchases are instant.

- CoinPayments — Receive payment via 70+ different cryptocurrencies — the crypto-PayPal.

- CoinMama — purchase Bitcoin and Ethereum w/ credit/debit cards & using cash through WesternUnion on their platform. Best for Euro purchases.

- Bit-Z — Newer Top 20 cryptocurrency exchange adding new, ICO coins all the time.

- Exmo Exchange — just launched their own coin and adding robust features to the trading platform.

- Gate.io — Cryptocurrency exchange listing new coins — get 10% off trading fees if you register with this link.

- CryptoPay — Spend your crypto. Can order a Euro, US Dollar or Pound crypto-debit card. Get 25% off using this link.

- LinkCoin — Your ticket to using LinkCoin, Bibox, and Bibox365 exchange products and ICO’s — mainly Asian cryptocurrencies that are not available on other exchanges.

- Cryptocurrency Resource Telegram Channel — acts as an ICO/blockchain news/resource channel for crypto beginners.

- Ledger Nano S — multi-cryptocurrency cold hardware wallet supporting Bitcoin forks. Keep your coins safe and offline. Cold storage.

- Kucoin — new exchange with its own token used to split exchange fees with holders, daily. Only exchange with NEO trading pairs too.

- Binance — 150+ cryptocurrencies with its own token used to pay exchange fees on the platform and give perks to traders on their platform.

- History of Cryptocurrency Exchanges — insightful look into the token-based exchange model and how exchanges have evolved.

- Cryptoversity by Chris Coney — The Online School That Pays You To Learn About Bitcoin, Crypto-currencies and Blockchains

- HitBTC Exchange — major exchange, access ICOs and multi-currencies.

- CoinTracking — Your personal Profit / Loss Portfolio Monitor and Tax Tracker for all Digital Coins

- Changelly — as easy as purchasing cryptocurrency gets — watch the exchange rate.

- CoinMate.io — Bitcoin arbitrage made easy.

- CEX.io — Buy Bitcoin w/ credit card, ACH bank transfer, SEPA transfer, cash, or AstroPay. Credit purchases are instant.

- CoinPayments — Receive payment via 70+ different cryptocurrencies — the crypto-PayPal.

- CoinMama — purchase Bitcoin and Ethereum w/ credit/debit cards & using cash through WesternUnion on their platform. Best for Euro purchases.

- Bit-Z — Newer Top 20 cryptocurrency exchange adding new, ICO coins all the time.

- Exmo Exchange — just launched their own coin and adding robust features to the trading platform.

- Gate.io — Cryptocurrency exchange listing new coins — get 10% off trading fees if you register with this link.

- CryptoPay — Spend your crypto. Can order a Euro, US Dollar or Pound crypto-debit card. Get 25% off using this link.

- LinkCoin — Your ticket to using LinkCoin, Bibox, and Bibox365 exchange products and ICO’s — mainly Asian cryptocurrencies that are not available on other exchanges.

- Cryptocurrency Resource Telegram Channel — acts as an ICO/blockchain news/resource channel for crypto beginners.

- Ledger Nano S — multi-cryptocurrency cold hardware wallet supporting Bitcoin forks. Keep your coins safe and offline. Cold storage.

- Kucoin — new exchange with its own token used to split exchange fees with holders, daily. Only exchange with NEO trading pairs too.

- Binance — 150+ cryptocurrencies with its own token used to pay exchange fees on the platform and give perks to traders on their platform.

Comments

Post a Comment